Winter 2017

Leveraging the U.S.-Mexico Relationship to Strengthen Our Economies

The U.S. and Mexican economies are more tightly intertwined than ever — and far from being a weakness, it’s a potential source of strength.

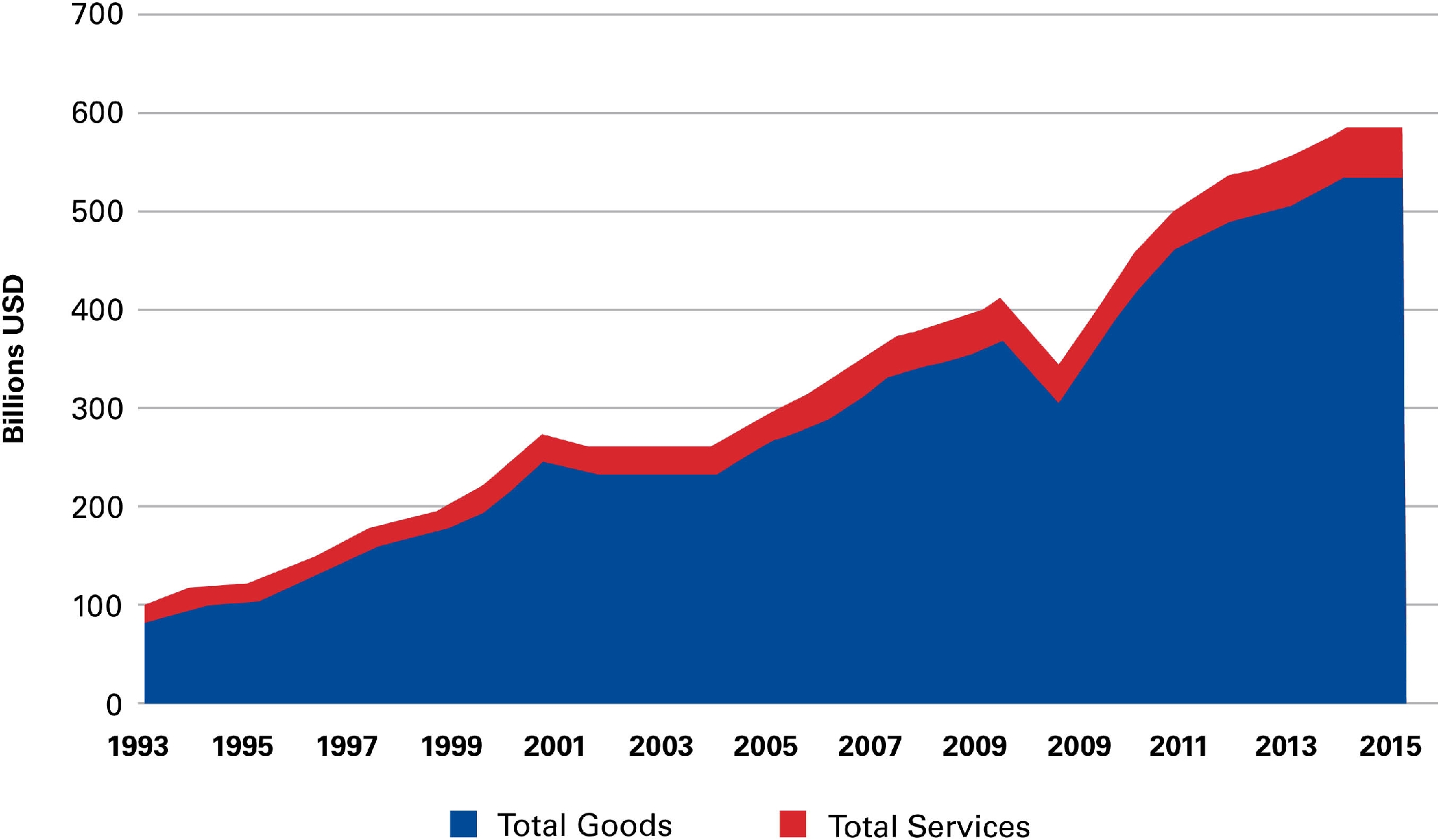

Tied together by both an accident of geographic proximity and through the deliberate integration institutionalized in the North American Free Trade Agreement (NAFTA) and other economic accords, the United States and Mexico have seen their economies become deeply intertwined. According to data from the U.S. Census Bureau, the U.S. Commerce Department’s Bureau of Economic Analysis, and the Organization for Economic Cooperation and Development (OECD), trade between the United States and Mexico has grown tremendously since the 1990s, with bilateral goods and services trade in 2015 reaching a total six times greater than before NAFTA was implemented in 1993. In 2015, bilateral trade reached $584 billion dollars, meaning that the United States and Mexico trade more than a million dollars’ worth of goods and services every minute. The United States is Mexico’s top export market, and Mexico is the second-largest foreign buyer of U.S. goods, second only to Canada. The bilateral trade relationship is enormous in size, and the U.S. and Mexican economies each depend significantly upon one another.

The crux of the partnership, though, lies in the way that cooperation within North America supports the region’s competitiveness in the global economy. The U.S.-Mexico economic partnership has the potential to play a key role in boosting regional exports to the rest of the world, which would support job growth in the United States and Mexico while helping to address the trade deficits currently run by both countries.

Regional Value Chains Link Our Economic Prospects

The immense importance of U.S.-Mexico economic collaboration can only be appreciated when one considers the unique nature of U.S.-Mexico trade. While imports from most countries are what they appear to be, foreign products, the United States and Mexico actually work together to manufacture products, with parts and materials zigzagging their way back and forth across the border as finished goods, from flat screen televisions to automobiles, are produced. In fact, approximately 50 percent of all U.S.-Mexico merchandise trade is in parts and materials, fueling each other’s industries. Further evidence of the way in which coproduction has come to characterize U.S.-Mexico trade is the fact that the top four broad categories of U.S. exports to Mexico are also the top four Mexican exports to the United States: machinery, vehicles, electrical machinery, and mineral fuels. We trade goods in the same categories because industries — including the automotive, aerospace, and medical devices industries — have built their supply chains across the binational region in ways that make the most of the advantages and specialization of each country. The construction of these regional value chains has fundamentally altered the way we must understand the U.S.-Mexico economic relationship. They link our business cycles, productivity, and long-term competitiveness in such a way that the prosperity of our nations tightly bound together.

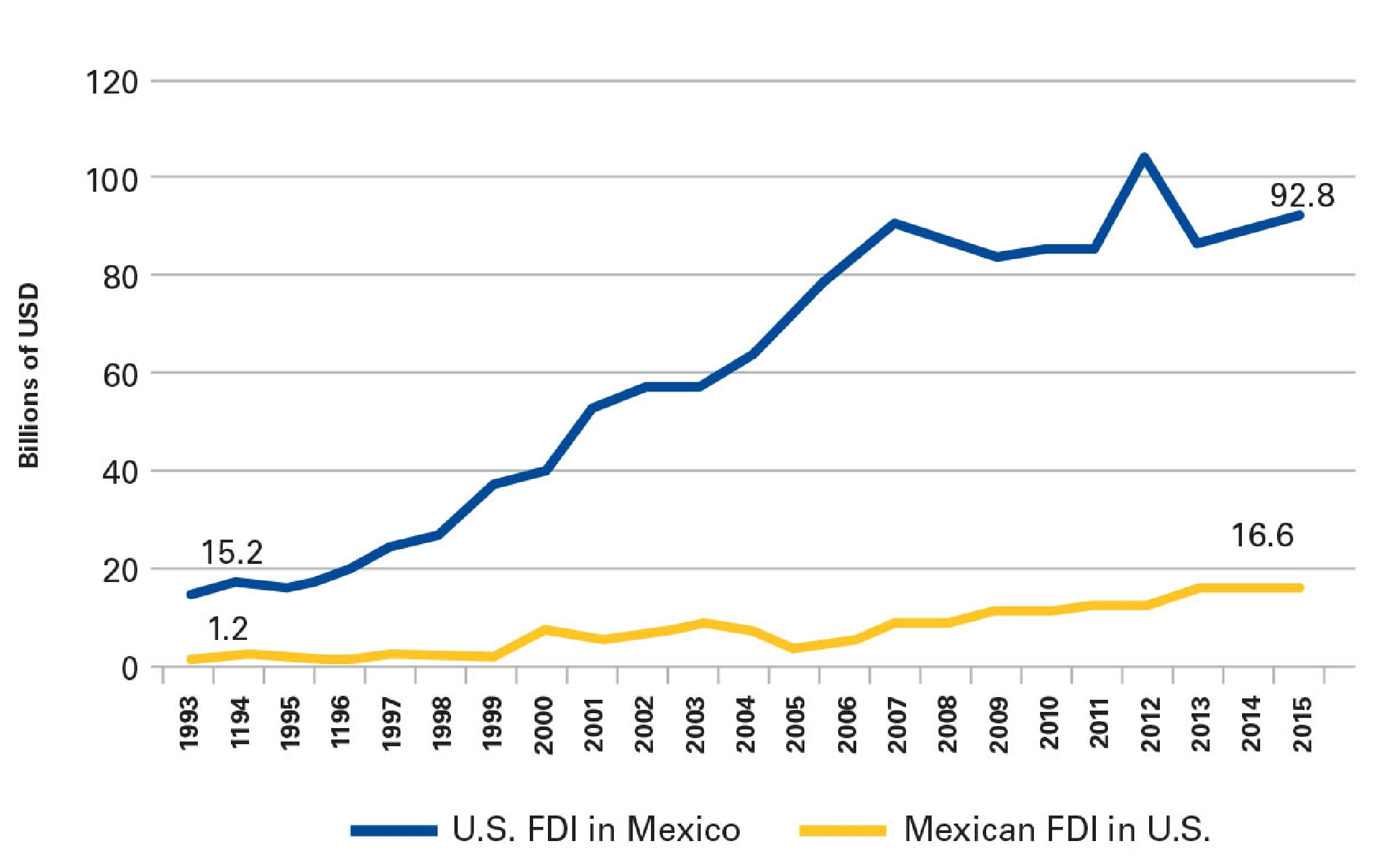

To build up the highly competitive and integrated North American production platform that now exists, U.S. and Mexican companies have made huge investments across the border. According to 2016 data from the Bureau of Economic Analysis, the total stock of U.S. and Mexican foreign direct investment in each other has risen more than sixfold since 1993 and now totals $109 billion dollars (figure 1). In 2015, U.S. direct investment—the direct ownership of businesses like a manufacturing plant or retail store—in Mexico reached $93 billion dollars (figure 2). Mexican investment in the United States, at $17 billion dollars, is smaller but growing quickly. It has quadrupled since 2005, and according to the International Monetary Fund’s most recent Coordinated Direct Investment Survey, the United States is the largest destination for Mexican FDI abroad.

Figure 1. U.S.-Mexico Trade in Goods and Services, 1993–2015

Figure 2. U.S.-Mexico Foreign Direct Investment Positions, 1993–2015

U.S. investments to build factories in Mexico and other countries have faced considerable criticism recently, understood as representing a loss for the U.S. economy. To be sure, there are times when firms close their factories in the United States and move to Mexico. However, there is strong evidence that investment by U.S. firms in Mexico is more often associated with job growth in their U.S. operations than with job losses. Theodore Moran and Lindsay Oldenski have analyzed U.S.-Mexico trade and investment data from 1990 to 2009, and find that on average a 10 percent increase in employment at U.S. companies’ operations in Mexico leads to a 1.3 percent increase in the size of their U.S. workforce, a 1.7 percent increase in exports from the United States, and a 4.1 percent increase in U.S. research and development spending. There is also evidence that the jobs created in the United States by this phenomenon require higher skill levels, reinforcing the need for training and retraining to ensure that workers benefit from this transition and qualify for these higher-paying positions.

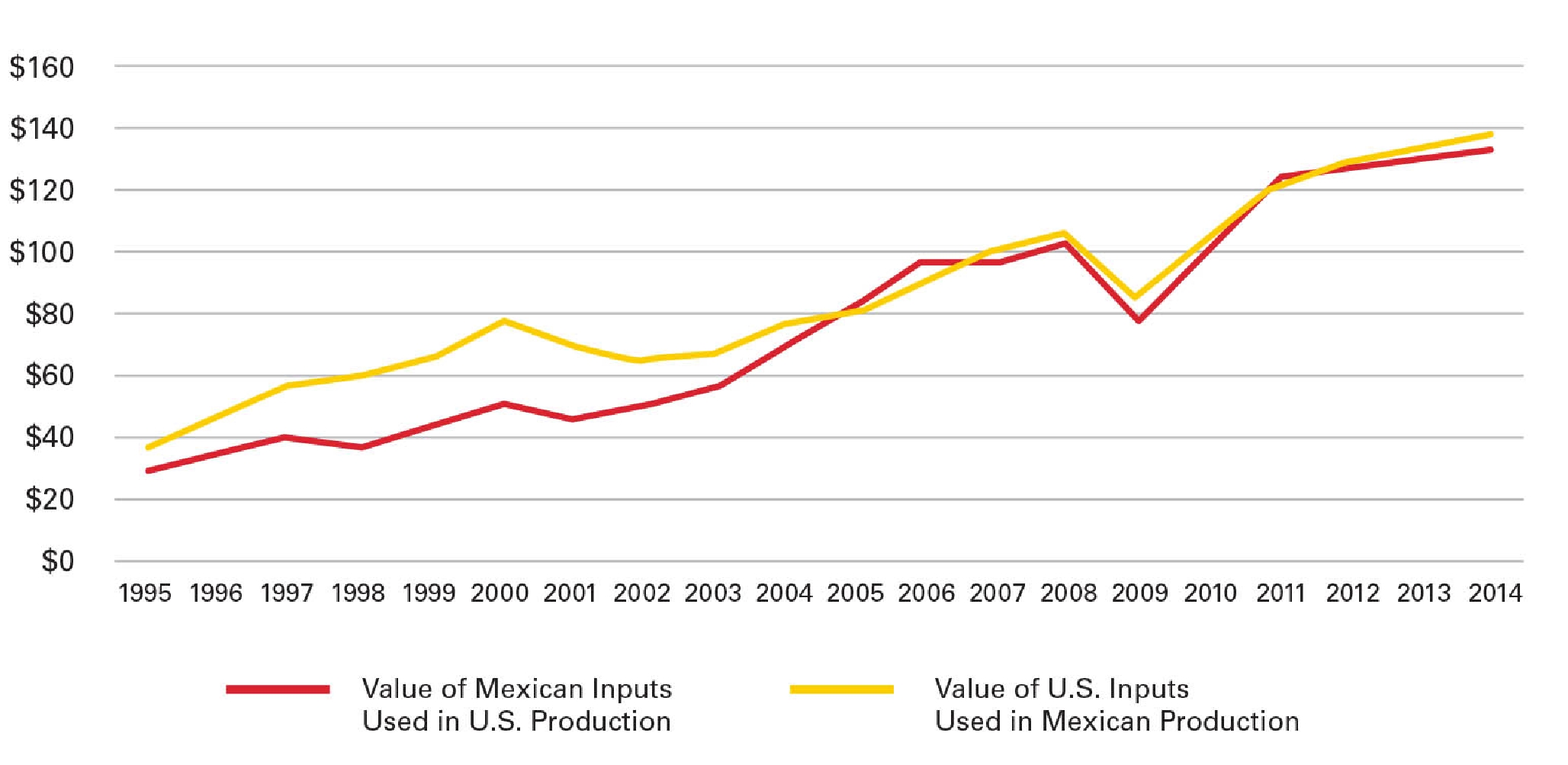

Even as the value of U.S. and Mexican participation in each other’s supply chains has continued to grow in absolute terms, some important developments can be appreciated by viewing how the relative share of this participation has changed over time. As shown in figure 3, the United States sells even more inputs to Mexico than Mexico sells to the United States. Given that Mexico sends approximately 80 percent of its gross exports to the United States, it should be no surprise that the vast majority of the inputs sent from the United States to Mexico make their way back to consumers in the United States. In this sense, a study using data from 2004 found that U.S. imports of final goods from Mexico contained 40 percent U.S. value added, a number significantly larger than was found for U.S. imports from any other country save Canada (25 percent for Canada vs.4 percent for China and 2 percent from the European Union [EU]).

Figure 3. Value of Foreign Inputs for Domestic Production, 1995–2011 (US$ Billions)

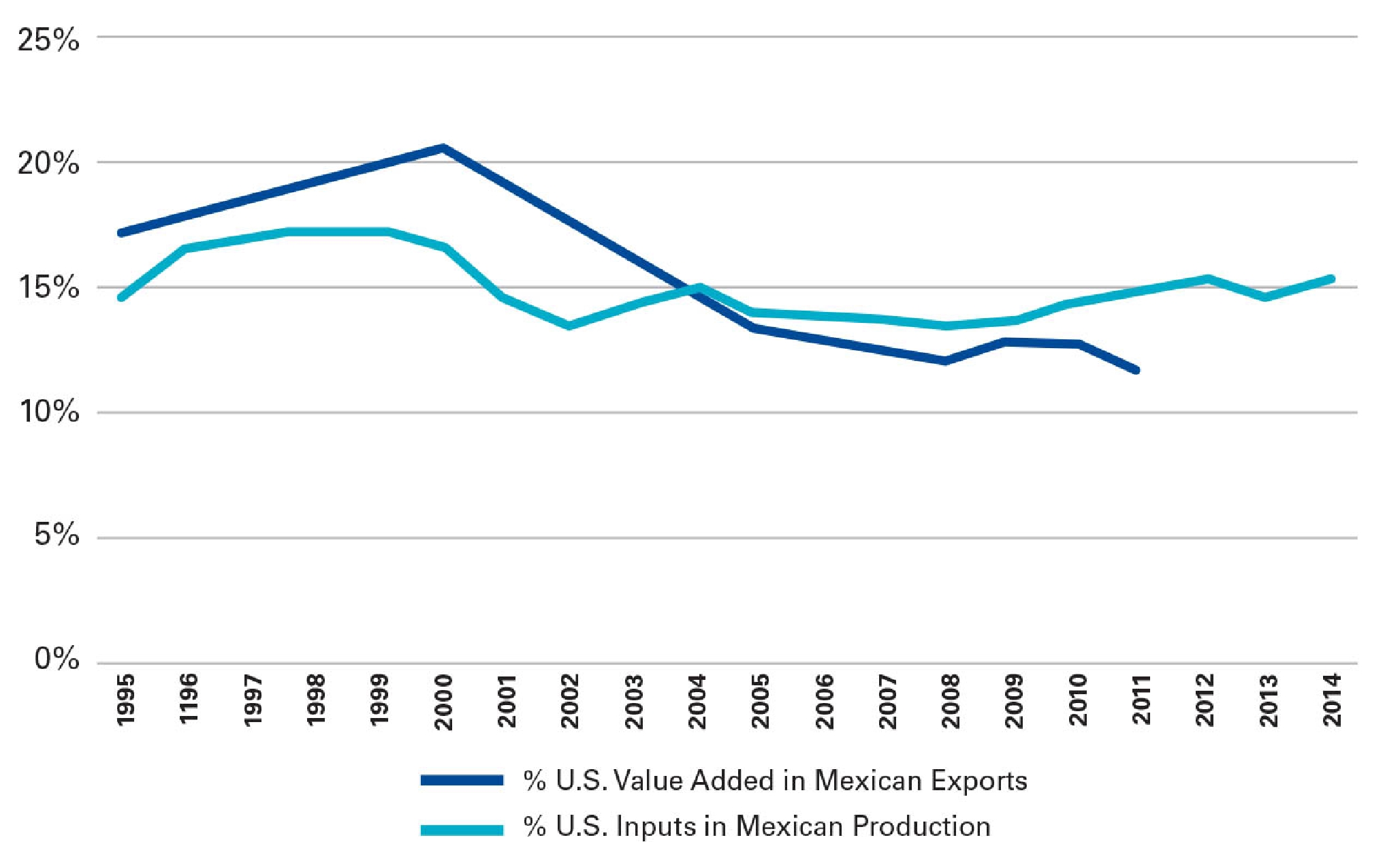

Nonetheless, the portion of total inputs used in Mexican production that come from the United States, as well as the U.S. value embedded in Mexican exports, has experienced some ups and downs (figure 4). During the 1990s, after NAFTA was passed, both measures rose, but as value chains became more global and China in particular grew its participation in global systems of production, the U.S. share fell. Rising wages in China and improved productivity in U.S. manufacturing operations may mean that the tide is again turning, but the United States and Mexico should not leave the health of their regional value chains to chance. Therefore the principal recommendation derived from this research is that the best way to grow U.S. exports and industry is by working closely with Mexico and Canada, our partners in production. The U.S.-Mexico relationship is not zero-sum, and there are significant risks that any effort to support U.S. industry by suppressing imports from Mexico could backfire. Instead, efforts are needed to strengthen regional value chains, make regional industries more competitive, and as a result grow exports from both countries to the rest of the world.

Figure 4. U.S. Share of Inputs for Mexican Production and U.S. Value in Mexican Gross Exports, 1995–2011

Trade and Employment: Training a 21st-Century Workforce

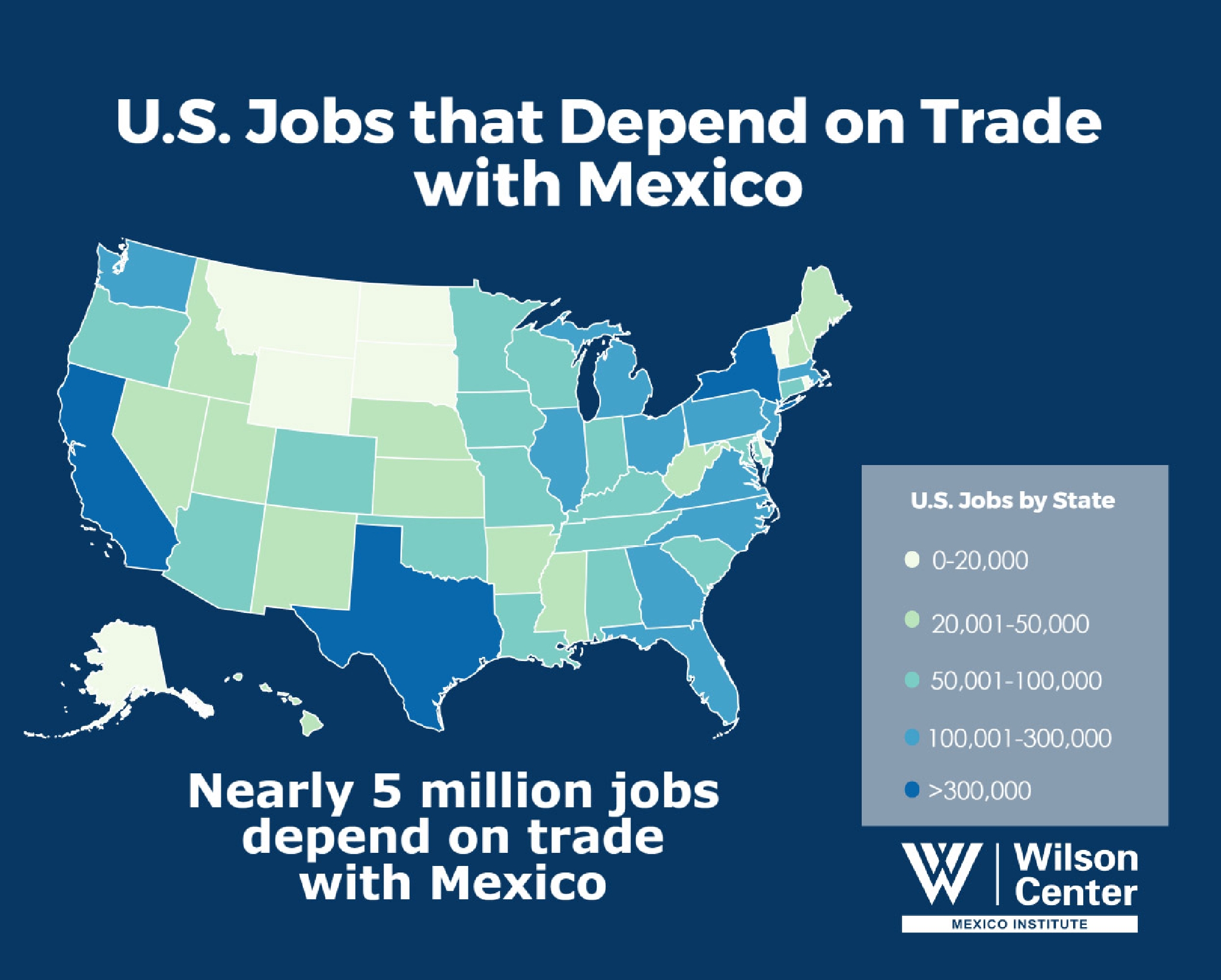

At the heart of President Donald Trump’s successful campaign was a promise to fight for the well-being of American workers, and indeed attending to the needs of each country’s workforce is vital to the prosperity of the United States and Mexico. Two key points follow from this. First, nearly five million U.S. jobs and a similar number of Mexican jobs depend on bilateral trade. Raising significant tax or tariff barriers to bilateral trade would threaten a significant number of those jobs in both countries. Second, for different reasons, both the United States and Mexico are in need of significant human capital investments. The global economy is transforming at a very fast pace. A failure to adequately and effectively invest in education and workforce development leaves huge segments of our populations in danger of being excluded from the benefits of the global economy, putting support for the international economic system and the health of our national economies at risk.

nearly five million U.S. jobs and a similar number of Mexican jobs depend on bilateral trade. Raising significant tax or tariff barriers to bilateral trade would threaten a significant number of those jobs in both countries.

New research commissioned by the Wilson Center’s Mexico Institute (figure 5) shows that 1 out of every 29 U.S. workers has a job supported by U.S.-Mexico trade. The model utilized in our study shows that if trade between the United States and Mexico were halted, 4.9 million Americans would be out of work. To be clear, trade expansion between the United States and Mexico, like trade between any two countries, both creates and destroys jobs; the study takes this fact into consideration and finds a net gain of 4.9 million U.S. jobs as a result of bilateral trade. These jobs are spread throughout the U.S. economy, both in terms of industries and geography, and policies are needed that not only preserve these jobs but also expand the benefits of the regional economy.

Figure 5. U.S. Jobs That Depend on Trade with Mexico

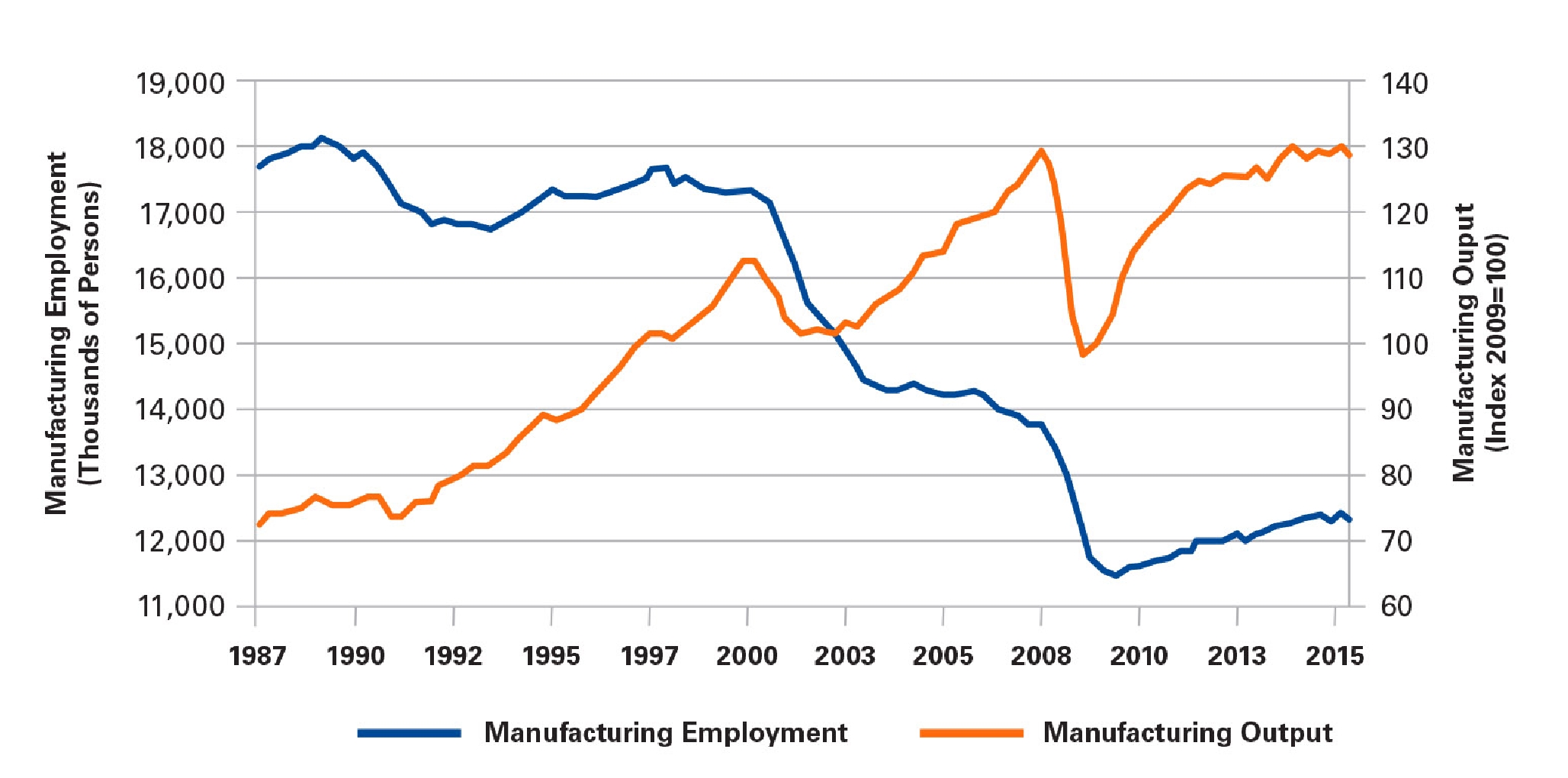

The U.S. labor market is in the process of a major, long-term economic transition. Productivity gains, driven mainly by automation and technology but accelerated by trade, are pushing manufacturing employment down even as output continues to rise. In this era of increasing service sector employment and a growing need for workers with technological know-how to design and run automated production processes, education and training are at a premium. In fact, since the financial crisis, more than 95 percent of the jobs created in the United States have gone to workers with at least some college education.

Mexico is in transition from being an efficiency-driven economy to an innovation-driven economy.

Mexico is still experiencing employment growth in its manufacturing sector, but that trend will not continue indefinitely. Indeed, industries that depend heavily on low-cost labor, such as large-scale textile- or shoe-making, have in large part already left Mexico. In their place, industries that require greater human capital, such as the auto and aerospace industries, have grown significantly as productivity in these sectors has risen. This evolution is healthy for Mexico’s development, and the next step on the path is for Mexico to grow its knowledge economy. As the World Economic Forum’s 2016 competitiveness report puts it, Mexico is in transition from being an efficiency-driven economy to an innovation-driven economy. A top-notch workforce is a prerequisite to successfully complete such a transition.

Deficits, Jobs, and Competitiveness: Setting the Right Goals

During the 2016 U.S. presidential campaigns, two key economic issues — jobs and the trade deficit — were discussed extensively in the context of the U.S.-Mexico relationship. Competitiveness was perhaps not discussed enough. Both jobs and the trade deficit are important economic issues for the United States, but care needs to be taken in the way that they are understood and used to create goals in the context of bilateral relations. Though not without its own conceptual pitfalls, putting regional competitiveness (and productivity) at the center of conversations on economic relations can help ground the discussion in the reciprocal nature of the U.S.-Mexico economic relationship and opportunities for mutual benefit.

Clearly, creating high-quality jobs deserves to be a priority in the U.S.-Mexico economic relationship. Mexico is not the cause of the vast majority of manufacturing job losses in the United States. (In fact, the impact of bilateral trade is net positive for U.S. manufacturing jobs.) As such, there are no potential changes in the U.S.-Mexico relationship that could reverse the decades-old decline in U.S. manufacturing employment shown in figure 6. Other goals are needed. The development of the regional production platform has played an important role in maintaining the overall health of U.S. manufacturing, and while improvements in the system of coproduction will not be able to reverse the overall trend in manufacturing employment, they can preserve some manufacturing jobs while growing employment opportunities in design, engineering, research, and business services. Similarly, efforts to strengthen the regional climate for innovation, entrepreneurship, and business growth can help ensure that the jobs and earnings associated with new companies and product lines accrue to the region. Most importantly, and unsurprisingly, the majority of work needed to improve employment opportunities for U.S. and Mexican workers has to do with workforce training and education. This is predominately a domestic task for each nation, but there are some ways that the U.S.-Mexico relationship can be leveraged to facilitate and strengthen workforce development in both countries.

Figure 6. U.S. Manufacturing Employment and Output, Seasonally Adjusted, July 1987–April 2016

The last time the United States had a trade surplus was in 1975. By 2016, the U.S. trade deficit had reached a half-trillion dollars. The main reason that countries export goods is so that they earn the income needed to purchase imported goods. From this perspective, when running a deficit, a country is getting more of the benefits of trade (imports) than what they are paying for with the work and capital needed to create goods for export. Credit fills in the gap, and so a nation’s trade deficit can only be maintained for as long as other countries are willing to continue lending that country more and more. Despite the near-term benefits of the U.S. trade deficit, many are concerned that the debt load being taken on by the U.S. government and society will need to be reined in over the coming decades in order to maintain low borrowing costs and to ensure economic stability. Related to this is a concern that some countries have kept their currencies undervalued in order to boost exports and thereby accumulate capital, which is often invested back in the United States through bond purchases. The issue is more complicated than often portrayed, but there are legitimate reasons to be concerned about the U.S. trade deficit.

According to the most recent data from the U.S. Census Bureau and the Bureau of Economic Analysis, trade with Mexico accounts for approximately 11 percent of the U.S. goods and services trade deficit. Trade with China makes up the majority (66%) of the trade deficit. However, in an era of global supply chains, these figures end up being distorted. Parts from outside the region used as inputs for products assembled in Mexico are incorrectly added to the U.S.-Mexico trade deficit. Using data from the OECD Trade in Value Added database, which takes into account the international movement of parts through the production process, one finds the traditional measure of the U.S. goods and services trade deficit with Mexico is 36 percent higher than the deficit calculated in value-added terms. Mexico also runs its own trade deficit with the world, meaning it is on the same side as the United States of the global imbalance that results in the U.S. trade deficit. In fact, given that Mexico’s annual exports to the world contain billions of dollars of U.S. content, growing U.S.-Mexico trade could actually play an important role in boosting U.S. exports and thereby reducing the overall U.S. trade deficit.

The overarching goal of U.S. and Mexican officials as they construct the next chapter of the bilateral economic agenda should be strengthening regional competitiveness. Each country can logically put the greatest focus on improving its own ability to attract and sustain investments and increase productivity, but this should be done with an understanding that the competitiveness of the two nations is complementary and mutually reinforcing. Given the integrated nature or regional value chains and the dependence that industry in each country has on imported inputs from the other country, productivity gains in one country drive increased competitiveness in the other. For example, Mexico’s 2013 telecom reform has driven down prices in that sector, and businesses throughout Mexico have lower phone bills as a result. This helps keep down the cost of goods produced in Mexico, and consequently increases the competitiveness of U.S. industries that import parts and materials from Mexico. In the same way, successful tax reform or productive infrastructure investments in the United States would be a boon for the Mexican economy. Many approaches to cutting the costs of doing business in the region can be enacted jointly, whether by simplifying customs procedures, making regulations in the two countries more compatible, or by other means. These types of mutually beneficial efforts to boost regional competitiveness ought to form the core of the bilateral economic relationship.

In order to support job creation and business opportunities, the focus of the U.S.-Mexico economic agenda should be on strengthening competitiveness and growing exports. As Wilbur Ross, President Trump’s nominee for secretary of commerce, suggested during his confirmation hearing, “I think the pro-growth thing is stimulating exports, much more than just curtailing imports.” The best way to achieve this is in cooperation with Mexico. Because the United States and Mexico build products together, the two countries have the opportunity to combine comparative advantages and utilize of economies of scale in ways that improve the competitiveness of each nation. Similarly, the fact that half of U.S.-Mexico trade is in parts and materials used as inputs for production suggests that the imposition of greater barriers to bilateral trade would raise the costs of production in North America, making regionally produced products more expensive for domestic consumers and less competitive abroad.

Updating NAFTA

An outright withdrawal from NAFTA would raise costs for industry in the region, thereby putting jobs at risk and diminishing competitiveness. Nonetheless, as an agreement created a quarter-century ago, there is ample opportunity for the Trump and Peña administrations to negotiate an update to NAFTA that would serve the interests of both countries and address the concerns of many of the constituencies for whom the agreement did not live up to its promises.

For one thing, NAFTA would benefit from a simple update to include products and modes of trade — especially trade in digital products — that did not exist in the early 1990s. On a related note, ecommerce tools have made it much easier for small businesses to find buyers abroad, but complicated customs procedures are still an intimidating hurdle for companies looking to begin exporting. Simplifying customs paperwork and raising the threshold for the value of shipments before they face customs revisions, known as de minimis, would boost U.S. small business exports to our neighbors. Congress passed legislation to raise the U.S. de minimis value to $800 dollars in 2016. Mexico and Canada, each of which begin requiring customs processing for significantly lower value shipments, should reciprocate.

Other aspects of the agreement are much in need of revision, whether it involves either strengthening or reducing restrictions. The NAFTA side agreements on labor and the environment are essentially toothless. Incorporating them into the agreement itself and strengthening enforcement provisions could alleviate concerns that companies might be choosing to leave the United States as a way to avoid higher labor or environmental standards. Conversly, though NAFTA and the recent bilateral aviation agreement have eliminated many restrictions, both the United States and Mexico still have many transportation rules that limit the freedom of companies or carriers when they operate on the other side of the border. There might be areas in which NAFTA’s rules of origin, which set the threshold for the amount of regional content needed to qualify for NAFTA’s tariff benefits, could be adjusted in order to encourage the use of more North American parts. During the review, care would need to be taken to also identify regional industries that could be pushed out of North America by stricter regional content requirements, preferring to forgo NAFTA benefits rather than pay tariffs on inputs they currently source from outside the continent.

The High-Level Economic Dialogue

As the U.S. and Mexican economies have become more integrated, the number of issues on the agenda has grown. Topics of economic importance addressed through bilateral coordination and cooperation now include food safety, agricultural pest control, the protection of sensitive industries, customs facilitation, anti–money laundering provisions, transportation infrastructure, energy security, natural resource management, economic development in border regions, financial literacy, educational exchange, research collaboration, and many more. To coordinate such a complex agenda and to be sure that the many U.S. and Mexican agencies responsible for such topics work together to advance regional competitiveness, the two governments have created the U.S.-Mexico High-Level Economic Dialogue, or HLED. The HLED brings together U.S. and Mexican cabinet members on an annual basis. To push through bureaucratic roadblocks and ensure progress is made across a wide range of agenda items, pressure from the highest level is essential, and the best way to ensure that kind of ongoing leadership is to institutionalize cabinet level meetings. To manage the complex bilateral economic agenda, the HLED needs to continue, even as important negotiations become the focus of the relationship. A single-issue economic agenda is simply not feasible given the depth of bilateral economic ties, and therefore a coordinating mechanism and leadership commitment is needed.

Right now, both nations lose out on billions of dollars of economic activity because of congestion at the busy U.S.-Mexico border, which adds costs to regional manufacturers and discourages travel and investment in the region.

A Competitive Border

There are significant opportunities to boost regional competitiveness through improved border management. Right now, both nations lose out on billions of dollars of economic activity because of congestion at the busy U.S.-Mexico border, which adds costs to regional manufacturers and discourages travel and investment in the region. A framework has been constructed over the past 15 years for U.S.-Mexico cooperation to simultaneously strengthen security and efficiency in border management, but further investments and the implementation of programs in development is needed.

Trusted traveler and trader programs offer companies and individuals expedited border crossings in exchange for undergoing background checks and committing to security standards, thereby allowing officers at the border crossings to focus their efforts on travelers and cargo that are not known to be low-risk. These programs, which cover cross-border private travelers (Global Entry and SENTRI in the United States; Viajero Confiable in Mexico), commercial drivers and shipping companies (FAST),and corporate supply chains (C-TPAT in the United States; Operador Económico Autorizado in Mexico), should be encouraged to enroll a larger portion of cross-border traffic. Furthermore, under current procedures, cargo is processed twice as it crosses the border — first as it leaves a country and then as it enters the other. Joint inspection programs, in which U.S. and Mexican border officials work side-by-side at facilities on either side of the border to clear cargo, are the future. By working together, U.S. and Mexican inspectors can better share information, reduce double inspection, increase the percentage of cargo that each inspects, and decrease staffing needs. These measures all facilitate trade while saving money and increasing border security.

Even with efficiency gains, significant investments in infrastructure will be needed. The federal government must play a central role in funding border crossings, but public-private partnerships can act as a multiplier in many cases. Big advances have already been made in developing a framework for such projects, but further work is needed to fully take advantage of private (as well as state and local government) participation. In addition to contributing funding, local stakeholders bring fresh energy and ideas to the governments. A prime example of this is the CBX passenger bridge that connects the Tijuana airport directly to the U.S. side of the border. Staffed by border officials from both countries, this privately funded and built project allows passengers from both sides of the border to access the airport directly, saving passengers time, increasing profitable airport traffic, and effectively expanding the number of flights arriving to and departing from San Diego. Additional efforts will be needed to continuously strengthen the use of technology at border crossings, to expand preinspection projects, to fully staff the crossings, to implement and eventually integrate U.S. and Mexican single windows for import and export processing, and to coordinate and prioritize broader transportation network investments.

Innovation, Education, and Entrepreneurship: From Building to Inventing

Because of the massive volume of merchandise trade between the United States and Mexico — over a half-trillion dollars per year — the bilateral economic relationship has tended to focus on ensuring the free and secure movement of goods between the two countries. Without doubt, such an agenda has yielded significant results. Further progress along these lines is still possible and desirable, but as the Mexican economy has developed and economic integration has deepened, new areas of economic cooperation are growing in importance. Mexico has evolved from an economy using low-cost labor as its principal comparative advantage to a middle-income country with a large middle class and an economy oriented toward higher value and higher skill manufacturing, exemplified by its large auto and aerospace industries. The next step in the development of the Mexican economy is the growth of a knowledge-based economy, an economy that not only builds products but also dreams them up and designs them. Such a transformation is underway and offers major benefits not only for Mexico but also for the United States. In the creative industries, for example, Mexican and American television and film makers have developed numerous partnerships and joint projects to create content in English and Spanish for regional and global audiences. Software developers from the Mexican tech industry in Guadalajara and Monterrey are working with counterparts across the United States to codevelop apps and other business tools. Investment flows, once almost entirely southbound, are quickly becoming more balanced, with well over 100,000 jobs in the United States now directly supported by Mexican direct investment.

To continue this trend, the two countries should strengthen collaboration on issues relating to education, innovation, and entrepreneurship. The Mexico-U.S. Entrepreneurship and Innovation Council (MUSEIC), for example, was created in 2013 to “promote and strengthen the cross-border design and innovation system to complement our cross-border production system.” MUSEIC has several subcommittees focusing on topics ranging from promoting women entrepreneurs to sharing best practices on commercialization and financing entrepreneurs with high impact ideas. Another example of the expanding economic agenda is the U.S.-Mexico Bilateral Forum on Higher Education, Innovation and Research, known by its Spanish acronym FOBESII, which seeks to “expand opportunities for educational exchanges, scientific research partnerships, and cross-border innovation to help both countries develop a 21st century workforce for both our mutual economic prosperity and sustainable social development.” Both FOBESII and MUSEIC have achieved some important results, but at the same time they are in many ways still nascent initiatives that can and should grow over time as successful pilots are replicated and scaled. Partnerships with subnational governments, civil society, and the business community are vital to their future success and should be actively expanded.

Investment flows, once almost entirely southbound, are quickly becoming more balanced, with well over 100,000 jobs in the United States now directly supported by Mexican direct investment.

Conclusion

The U.S.-Mexico economic relationship, as constructed over the past several decades, offers concrete benefits to millions of Americans and Mexicans. It is composed of a large and deep trade relationship in which the two countries coproduce products across regional manufacturing networks that enhance the competitiveness of each. This current state of interdependence and mutual gain also naturally means that a deterioration of the relationship could put the economic security and prosperity of citizens of both countries at risk. Instead, the two countries should work together to boost productivity and strengthen the competitiveness of the regional economy. They should aim to not only build things together but to also invent them, to design them, and to open markets around the world in which to sell them. The economic challenges of each country are real. They require significant improvements to the domestic economic policies of each. But to the extent that they are international, they are best faced together.

Christopher Wilson is Deputy Director of the Mexico Institute at the Wilson Center, where he leads the Institute’s research and programming on regional economic integration and U.S.-Mexico border affairs.3

Cover photo courtesy of Wikimedia Commons