Spring 2015

GDP growth is strong. That doesn’t mean inequality is going anywhere.

Growth in GDP hasn’t done much for the average American in decades, but it can provide some political cover to narrow the wealth gap: We can afford it now.

SIX YEARS INTO THE OBAMA PRESIDENCY, we’re seeing the emergence of a new rationale to act on inequality.

It got a nationally televised tryout during January’s State of the Union address, when President Obama introduced a “middle-class economics” that did not spring solely from the much-drawn fonts of fairness or utilitarianism. The bar for moral and rational arguments is a high one when the winners are diffuse, influential, and unmotivated (climate change has proven this).

Instead, Obama tried an appeal to excess: “At this moment — with a growing economy, shrinking deficits, bustling industry, and booming energy production — we have risen from recession freer to write our own future than any other nation on Earth.” Then the follow-up: “Will we accept an economy where only a few of us do spectacularly well? Or will we commit ourselves to an economy that generates rising incomes and chances for everyone who makes the effort?”

The U.S. economy of the last few years was already the largest in world history. What’s changed in recent months is evidence that growth has returned. In the third quarter of 2014, GDP hit its fastest quarterly growth rate since 2003, before slowing to a still-healthy 2.2 percent at the end of the year. Despite signs of a winter slowdown, economists are bullish on 2015, with consensus forecasts predicting the strongest GDP growth since the recession began.

Forget for a moment that growth hasn’t done much for the average American in decades — median household income today is lower than in 1989, according to the Census Bureau, though the economy’s size has nearly doubled. What growth can do is provide some political cover and reassurance about narrowing the wealth gap: We can afford it now.

Progressive measures in the name of fighting inequality are multiplying, boosted by this turn in argument. The President’s speech was a preamble to a new federal budget proposal he has framed as a strike at inequality: free community college, subsidies for childcare, tax credits for education, increased taxation of the wealthy and corporations — but coupled with lower deficits, thanks again to the gains of a rebounding economy. In the state of New York, Governor Andrew Cuomo is now pushing an inequality agenda that most notably features a raise of the state minimum wage. “The world has changed,” he told the press of the hike. “The market is strong and I believe the market, this market, at this rate of strength, can handle this.”

Private industry, too, sees a reason and an opportunity. Gap, IKEA, and Starbucks raised hourly wages last year after seeing their highest profits in years. Health insurance provider Aetna has announced it will set a wage floor this year of $16 an hour, raising the pay of many employees by one-third. Aetna’s CEO, who has asked his company’s executives to read Thomas Piketty’s Capital in the Twenty-First Century, said the move was “about the whole social compact.” This is a company that also saw its operating profit jump to $4 billion last year; raising wages will cost a comparatively paltry $14 million in 2015. “He said he isn’t certain the changes will pay for themselves in purely financial terms, but the cost is small relative to Aetna’s size,” The Wall Street Journal reported in January. In other words: We can afford it now.

MERE MONTHS AGO, a prevailing reason to do something about inequality was not the U.S. economy’s strength, but its frailty. Economists — from the Stiglitzes and Krugmans on the left to mainstream prognosticators at Standard & Poor’s — pushed the notion that inequality was hurting the economy by creating a long-term drag on consumer demand; that is, when lots of people are poor, they don’t buy enough things. As recently as August, The New York Times declared that “worries that income inequality is a factor behind subpar economic growth over the last five years (and really the last 15 years) is … something that even the tribe of business forecasters needs to wrestle with.” Others on the left, Piketty included, had argued that inequality caused the recession in the first place by forcing down lower-class purchasing power, ultimately replaced with debt.

A few quarters of faster growth doesn’t disprove these theories, but it casts them aside in popular discourse (summer always makes a faulty heater irrelevant). The new framing invites a different set of questions. Should people who care about inequality be cheering the economy’s growth? If the economy is indeed picking up again — which is no sure thing — what does that mean for the wealth gap, and the popular will to change it?

There is reason to believe that growth is already having an alleviating effect. The U.S. economy is now adding jobs at the fastest rate since the 1990s, and even wages are finally showing signs of picking up, with average hourly earnings rising the most in January since the recession.

But there could be a limit to those effects. One of the great tricks of Piketty’s book is the way it dominated the Pavlovian media cycle while preaching an antithetical patience and skepticism of short-term causality, the means to the very kind of sweeping conclusions consumable by media. Two of those less cited conclusions might be useful checks to the sudden optimism about growth vis-á-vis inequality, and the headway that new jobs and rising wages might finally make.

First, high growth in a mature economy has so far proven to be historically unsustainable. Second, inequality does not tend to lessen during times of high growth – instead, it usually increases at a slower rate. This is explained by the mechanics of Piketty’s most well-known concept, r>g, which contends that inequality widens as the rate of return on capital (r) outpaces growth (g). The rate of return has hovered at nearly 5 percent annually over the decades, making it unlikely for an advanced economy to match in growth rate. Piketty’s sometimes collaborator, Emmanuel Saez, has also found evidence that the wealthy take a larger share of total income during a rebound than during a downturn. Taking history’s long view, faster growth has been a good thing for inequality in the same way that a larger bucket helps stop a boat from sinking.

Then there is the seeming momentum that growth has lent to measures targeting inequality. Though the moment’s political wisdom is that most of Obama’s proposals won’t pass anytime soon, Republican lawmakers are publicly acknowledging the problem of a widening wealth gap in a way they have not before. The potential exists that budget negotiations — or the coming 2016 presidential election, when candidates on both sides will face pressure on the issue — may shape a deal or create alternative proposals.

The hope — likelihood, even — is that a growing economy can contribute converging forces. But there is something else instinctive, intuited over the years by everyone from Marx to pro sports teams, that it is shrinking and not growing resources that result in a unique pressure for reform.

INEQUALITY BECAME THE BUZZWORD it was last year partly because of the anxiety that economic stagnancy was making it worse, that most Americans were getting less of a pie that itself wasn’t growing. By extension, a return to growth may ease zero-sum pressures.

The writer Rebecca Solnit recently considered the causes of movements for change — why 2014, in her words, became a year of insurrection by women against male violence: “I live in earthquake country, and here we know that the sudden shake-up is preceded by years or decades or centuries of tension. But that doesn’t mean we know when an earthquake will come.” Predicting social and political movements — or their absence — is a dangerous game, and about as easy as predicting natural disasters. But consider a thought experiment with a few parameters.

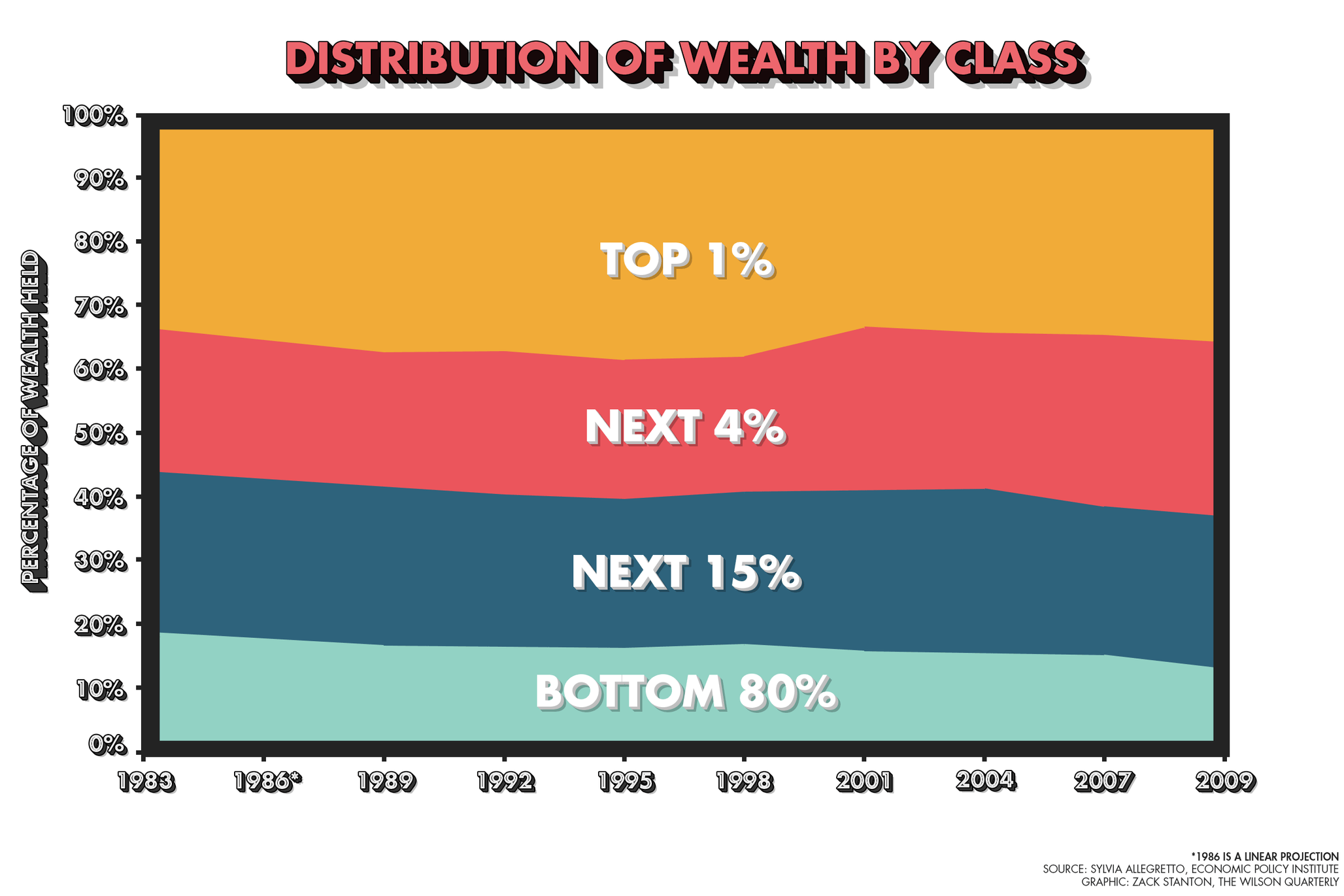

Americans live in one of the most lopsided economies in modern history; the bottom half of U.S. households together own only 1 percent of the country’s wealth, according to the Federal Reserve’s survey of consumer finances. There is dissent over why this is, but most would agree that the forces causing it have built up over decades.

There is today a political necessity of addressing inequality, but handcuffed to the additional political necessity of curbing any address. We see this in the nascent candidacies of 2016’s frontrunners. Hillary Clinton has met with some 200 experts to finesse attacks on inequality without upsetting the wealthy. Conservatives, with Jeb Bush leading the way, are also moving to own inequality as an issue, but they have fewer levers within traditional policy options, and are meeting the predictable resistance from the party’s base.

What would any of the country’s long hoped-for economic gains (say, positive movement on wages and jobs) and the shiny new measures that accompany them (infrastructure investment, say, or tax credits) ultimately mean? Would they be enough to change the forces of divergence in a meaningful way? Or would they be just enough to notch points for elected officials with limited operating room — more cynically, enough to pass longstanding political agendas in the name of high-polling concerns? Would growth be enough only to ease the tension that’s been gathering, and to keep the harder questions at bay?

A resurgent economy could mark the slipping away of opportunities as much as the rise of new ones. The history of postwar inequality is not one of dramatic turns and political heroes and villains, but gradual, replicating processes of wealth concentration and redistribution. Growth has been a part of that process, as has economic optimism.

* * *

Alfred Lee is a Knight-Bagehot Fellow in Economics and Business Journalism at Columbia University. He was previously a reporter in Los Angeles and has contributed to outlets including NPR and the Los Angeles Review of Books.

Cover image courtesy of Shutterstock, modifications and other illustrations by Zack Stanton