Winter 2012

Great Recession or Mini- Depression?

– Robert Z. Aliber

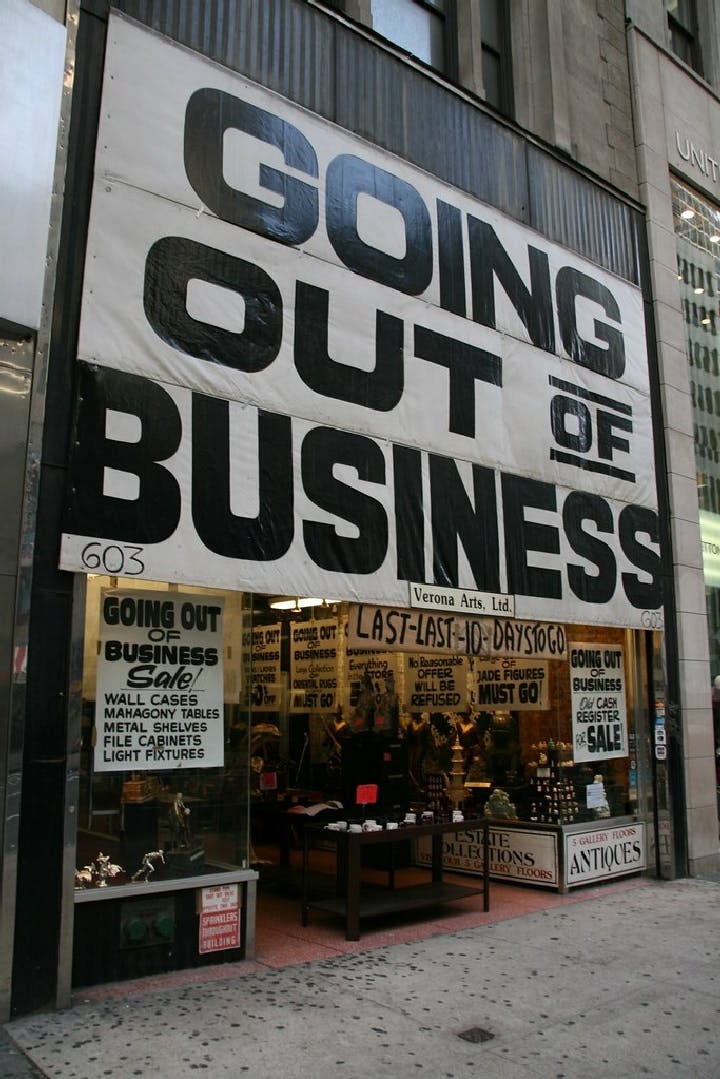

Words may be failing economists and others who characterize the economic downturn that began in 2008 as "the Great Recession." "Mini-Depression" may be more like it.

The recession that began in January 2008 was more severe than any of the other 10 recessions the United States has endured since World War II. The decline in the nation’s gross domestic product (GDP) surpassed previous records and the percentage of American workers without jobs nearly did so. And the expansion of the U.S. economy since the recession officially ended in June 2009 has been sluggish, challenging the economists’ adage “The sharper the decline, the quicker the recovery.” The growth rate in 2011 fluctuated around two percent, much too low to make a significant dent in the number of Americans without work, despite the Obama administration’s injection of more than $750 billion into the national economy and the provision of virtually free money to financial institutions by the Federal Reserve.

Most recessions since World War II have come about because the Federal Reserve curbed the growth of credit to restrain inflationary pressures. The Fed sold bonds, the bonds’ prices fell, and individuals, commercial banks, and other financial firms bought the bonds at their attractive new prices. That reduced the reserves of the commercial banks, leaving them less money to lend to property developers and households. As sales of new homes declined, real estate developers produced fewer new homes, increasing unemployment in the building trades and a host of real estate–related businesses. Before long, this process would pitch the nation into recession.

Once the Fed became convinced that the inflation threat had abated, it would reverse its credit policies: The supply of credit would expand, and developers would produce more homes, knowing that the underlying demand was still strong.

The recession of 1981–82 was especially severe because the Fed was determined to stamp out the expectations of accelerating inflation that had developed in the second half of the 1970s. An increase of tenfold or more in oil prices during the 1970s had kindled boom conditions in Texas, Louisiana, and other energy-producing states. Sharp increases in the prices of wheat, corn, and other grains had triggered a spike in prices of farmland in the grain-producing states of the Great Plains.

The contractive monetary policy adopted by Fed chairman Paul Volcker in October 1979 led to the highest interest rates since the Fed was created in 1913—short-term rates climbed to more than 20 percent and long-term rates to more than 10 percent. Unemployment rose above 10 percent. As inflationary expectations were reversed, the prices of hard assets people had acquired in the late 1970s as inflation hedges—gold and silver, farmland, real estate, and collectibles—declined, in some cases sharply, as bubbles in these assets burst.The recession brought grain prices down, which caused theprice of farmland to tumble. Ahandful of large banks failed, and the federal government was forced to bail out hundreds of smaller banks and savings and loan associations. But, as had been the case in every previous postwar recession, real estate prices remained stable at the national level, even though there were significant drops in areas that had experienced booms.

The distinctive feature of the most recent recession was the massive failure of leading financial firms, including Countrywide Financial, Washington Mutual, Wachovia, and many small community banks in Georgia and Florida. The U.S. investment banking industry was decimated: Bear Stearns and Lehman Brothers failed, and Merrill Lynch was saved in early 2009 only because Bank of America bought it. But then Bank of America and Citibank needed huge infusions of government money to stave off collapse. AIG, the largest insurance company in the world, would have closed without the tens of billions of dollars pumped into it by the Fed.

Countrywide and Washington Mutual had been extremely aggressive in extending mortgage credit after 2000 as each battled to become the nation’s dominant mortgage lender. They weakened their credit standards and became inventive at developing new kinds of mortgage loans that reduced the interest payments that borrowers were required to pay in the first few years, allowing home buyers to take on debts that were large—much too large—relative to their incomes.

Easy credit contributed to the surge in real estate prices, which climbed by 10 percent annually at the national level between 2002 and 2006 and by 20 percent a year in the nation’s 16 most rapidly growing states, in the South and West. Two government-sponsored lenders, the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac), which between them indirectly provided half of the nation’s mortgage money, were aggressive buyers of mortgages from Countrywide and Washington Mutual. Fannie Mae and Freddie Mac were able to sell their bonds to investors because some foreign governments and their sovereign wealth funds were of the impression that these bonds were guaranteed by the U.S. Treasury.

Eventually, rational exuberance morphed into irrational exuberance, and Americans started buying homes and apartments simply because prices were increasing and they saw an exceptional opportunity for profit. And prices were increasing mainly because Americans were buying property. The surge in prices led to a boom in construction; the number of new housing units constructed was one-third larger than the number needed to accommodate the growth of the population and fulfill other needs. By the end of 2006 there were more than two million unoccupied homes in the United States, all built with the expectation that prices would continue to increase.

The decline in real estate prices that started at the end of 2006 was not prompted by any Fed action but by a slackening of foreign demand for Fannie Mae and Freddie Mac bonds. Many of the high-risk borrowers who had received mortgage loans from Countrywide and Washington Mutual were unable to make their first payment, often because the mortgage refinancing that had supplied so much easy money suddenly dried up. Borrowers began defaulting on their mortgages. One of the great puzzles of the recession is how the Fed could have been so oblivious to the bubble in home prices and the surge in housing starts.

The decline in real estate prices in the first few months of 2007 was gradual. The true dimensions of the crisis became clearer in August, when Countrywide suddenly experienced a “run”; it was no longer able to roll over the maturing short-term loans it had been using to underwrite its aggressive funding of new mortgages. Other lenders stumbled, too. Countrywide was saved only when Bank of America bought it early in 2008 (much as the giant bank would avert the extinction of Merrill Lynch the following year). Once property prices stopped increasing, the calculus of developers and investors changed radically. Now the interest rate on their debt was higher than the annual increase in prices. Some decided to sell, pushing prices down further. Then millions of people who had recently bought property found themselves with “upside-down” mortgages—the amount they owed on their mortgage was greater than the market value of their property. Others who had taken out home equity loans based on the increase in the value of their property and had slim equity also were underwater. More houses went up for sale, putting additional downward pressure on the housing market. A race to the bottom was on.

The hangover from the property price bubble is one major cause of the sluggishness of the economic expansion over the last several years. New housing starts and completions have remained at low levels as the economy absorbs the excess homes built during the bubble years. The process has moved slowly, despite low interest rates, because of high unemployment and the continuing decline in home prices. Annual housing starts have averaged much less than half their average level in the 1980s and ’90s. If starts were running at the old rate of 1.5 million annually rather than in the current range of 500,000 to 600,000, the nation’s GDP growth rate would be two percentage points higher and the unemployment rate two percentage points lower than they are today.

Unlike recoveries from typical Fed-induced recessions, postbubble economic expansions typically are slow because people are intent on rebuilding their wealth by increasing their saving relative to their spending. At the same time, banks and other financial institutions become more cautious lenders, so that while interest rates are low, credit is relatively scarce.

The current recovery has also been slowed by the $300 billion increase in the nation’s trade deficit since 2008. Each increase of $1 billion in the trade deficit—either because Americans are spending more on foreign goods or foreigners are spending less on U.S. goods—represents a loss of 12,500 American manufacturing jobs. If the trade deficit in 2011 had been in the same ballpark as in 2008, the United States would have had two to three million more manufacturing jobs than it did.

What remains distinctive about the recession of 2008–09 and its continuing aftermath is the decline in home prices. The last time such a drop occurred at the national level was during the Great Depression. That calamity, however, was marked by a much more severe decline in stock prices—which dropped more than 90 percent between 1929 and 1933. Several thousand banks failed, consumer prices fell by more than 30 percent, and exports declined as many countries in Latin America and Europe abandoned the gold standard and devalued their currency. Unemployment in the United States at one point reached 25 percent.

The conditions in the 1920s and mid-2000s in the run-up to economic collapse were surprisingly similar. The American economy grew strongly in the ’20s, with surges in the production of automobiles and the construction of highways, and the introduction of electricity and the telephone in millions of households. Home prices increased, but far less dramatically than they did in the 2000s. Stock prices tripled from the beginning of 1927 to the autumn of 1929, when the crash occurred. Irrational exuberance took hold. Investors were buying stocks because stock prices were increasing, and prices were increasing because investors were buying stocks. Stock market wealth was a smaller component of household wealth than it is today, but higher stock prices helped reduce the cost of capital and increase business investment.

In both the 1920s and the mid-2000s, economic euphoria was pervasive as bubbles in asset prices led to surges in spending—and those spending increases further inflated the bubbles that had fostered them in the first place. Then asset prices imploded, household wealth shrank, and banks suffered large losses when borrowers were unable to repay their loans.

The recession of 2008–09 and its aftermath more closely resemble the Great Depression than any of the other post–World War II recessions. Indeed, this episode might aptly be called the Mini-Depression of 2008–09. Both economic declines involved the interplay among the collapse of real estate values, the decline of banks’ capital and their willingness to lend, and the desire of households to rebuild financial wealth. By contrast, the standard postwar recessions did not involve significant declines in either stock or real estate values or large loan losses by lenders (apart from the localized failures of banks and thrift institutions in the oil- and grain-producing states as a result of the 1980–81 recession). The decline in the capital of banks and other financial institutions between 2007 and 2009 was much greater than the combined declines during the previous 10 recessions.

The 2008 recession did not cascade into another depression because the U.S. Treasury and the Federal Reserve provided abundant funds to recapitalize the banks and limit their distress selling of assets. This intervention—which began in September 2008—sharply reduced the likelihood that a liquidity crisis would morph into a solvency crisis. Had the Treasury and Fed intervened several weeks earlier, however, the bankruptcy of Lehman Brothers would have been prevented, the 2008 recession would have been significantly less severe, and the postrecession expansion would have been more robust.

Even this intervention would have been unnecessary had the Fed and government bank regulators recognized the emerging bubble in property prices in 2004 and 2005 and used their authority to curtail the risky and pernicious credit practices of Countrywide, Washington Mutual, Fannie Mae, Freddie Mac, and other financial institutions. There was abundant evidence, based on the growth rate of the American population, that housing starts far exceeded demand, and the decline in the credit standards of some of the most aggressive mortgage lenders was no secret. Yet when real estate prices began to fall and the tightening of credit led to the collapse of big lenders, it became clear that neither the Federal Reserve nor the U.S. Treasury had contingency plans to deal with runs on banks and other financial firms. A few ounces of prevention would have yielded a ton of cure.

* * *

Robert Z. Aliber, a former Wilson Center fellow, is a professor emeritus of international economics and finance at the University of Chicago's Booth School of Business. His latest book (with Charles P. Kindleberger) is Manias, Panics, and Crashes: A History of Financial Crises (6th ed., 2011).

Photo courtesy of Flickr/timetrax23