Winter 2012

The Debt Bomb

– Louis Hyman

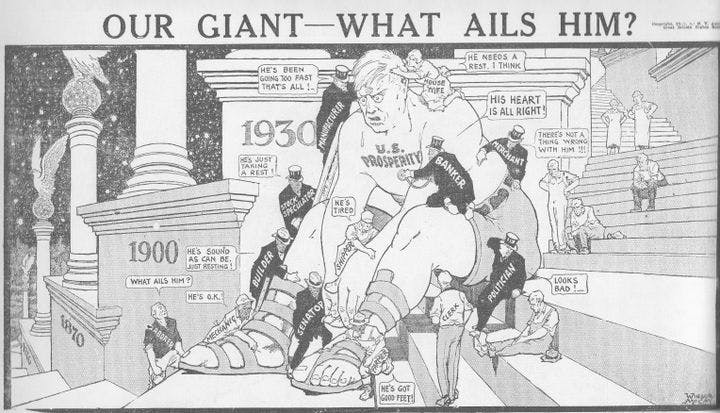

When wages stagnate and inequality rises, Americans try to borrow their way toward the American dream. Inevitably, the bubble bursts. But we can learn from the lessons of 1929.

DICK AND JANE SMITH MET SHORTLY AFTER THEY MOVED TO THE CITY. Sparks flew, declarations of love were exchanged, and rings and vows inevitably followed—and then they began their search for a home of their own. Though he didn't have a college degree, Dick had recently found work in a new industry that was sweeping the country. The company’s initial public offering a few years back had been one of the most successful in history. Dick and Jane, like the rest of the country, were caught up in the heady optimism of what pundits called a new era of perpetual growth.

Flush with love and short on cash, the Smiths went to their local bank to find out if they could get a mortgage. After a few calculations, the mortgage officer informed them that an “amortized” mortgage—which required payments on both interest and principal every month—would not get them the house they wanted. Dick’s income was just not enough to cover the payments, but there was another option that, the loan officer told them, most smart people were using these days: an interest-only “balloon” mortgage. It would allow them to buy a house immediately, and sleep soundly with the knowledge that their household income had nowhere to go but up, along with real estate values. When the time for bigger payments finally came a few years down the road, they could simply refinance with a new loan.

The couple moved into their house, and Dick went to work. Jane filled the house with contemporary furniture purchased on an installment plan. While she bought sofas, Dick bought a Chevy. His father had only ever paid cash for cars, but now consumers could get auto loans. Though the Smiths didn’t have savings, they did have Dick’s steady income. If they could have all their dreams come true in 1928, then 1929 could only be better!

The parallels between Dick’s manufacturing job at General Motors in Flint, Michigan, in 1928 and today’s tech job in Silicon Valley are unsettling, but the larger structural similarities between the 1920s and the present are truly terrifying. With credit, the Smiths and millions of other Americans of that time and our own borrowed their way to the American dream. In both eras, a boom in consumer credit was made possible by the invention of new ways to repackage and sell individuals’ debt in the financial marketplace. And in both eras, the world made possible by credit came crashing down in a financial cataclysm.

In the last hundred years, economic inequality in America has peaked twice: in 1928 and in 2007. It is no coincidence that our periods of greatest inequality have coincided with excessive lending. An industrial economy based on mass production requires mass consumption. Either credit or wages must be provided to keep the wheels of industry turning. When wages stagnate and inequality widens, debt gains nearly unstoppable momentum.

In the decades between those two moments in our socioeconomic history lies the great era of post–World War II prosperity, and here too there are lessons to be learned. That prosperity rested to a large extent on policies the federal government put in place in response to the crash of 1929 and the Great Depression. Yet those same policies laid the foundation for today’s financial crisis, as the New Deal order dissolved and some of its innovations were turned to new ends. It would be almost comforting to embrace the tales journalists and others now spin that place all culpability at the feet of bankers of vast cunning and greed, or at the other end of the spectrum, with big government, but the true causes are more complex and unsettling than such morality tales suggest.

Borrowing is as ancient as humankind, but markets for consumer debt are as modern as a bobbed haircut. In the 1920s, a handful of changes in business and law (such as the easing of restrictions on loan interest rates) combined to move personal debt from the margin of capitalism to its center. Although your grandparents told you nobody borrowed in the good old days, it was debt, ingeniously packaged and commodified, that enabled the growth of the 20th-century economy. In the Roaring Twenties, Americans relied on it to buy their first automobiles, and retailers began to promote installment credit to sell other goods.

In 1930, before the full consequences of the crash of 1929 had become apparent, the economist W. C. Clark wrote that when the “economist of the future compiles the business annals of the past decade, he will find the key to our prolonged and unprecedented prosperity in the stimulus provided by two great industries—building construction and automobile manufacturing.” Houses and cars could not be more dissimilar, one the epitome of rootedness and permanence, the other the emblem of the 20th century’s new ethos of mobility and disposability. But houses and cars were oddly similar, as Clark noted, in how they were purchased—on credit.

Balloon mortgages played to the optimism of 1920s home buyers like Dick and Jane, who, prodded by resurgent prosperity and rapid urbanization, bought into one of the great housing booms of the 20th century. Most of the money that fueled this boom didn’t come directly from banks, but from financial instruments called “participation certificates” or “mortgage bonds” that resembled today’s mortgage-backed securities. Banks lent mortgage money to home buyers, then sold participation certificates to investors, who received regular interest payments from home buyers’ monthly mortgage payments. As long as investors kept buying certificates, the banks had no trouble refinancing homeowners’ balloon mortgages when they came due. In 1926, Time reassured readers that “real estate bonds are by no means jeopardous investments. In fact, they should be the best of all securities, for they are backed by tangible buildings and real estate.”

Investors’ appetite for mortgage bonds grew enormously. Sales increased more than 1,000 percent in the first half of the decade. Yet the system was seriously flawed, in much the same way the contemporary mortgage business is flawed: The people selling the mortgages usually didn't put their own money at risk. Banks that issued mortgage bonds frequently insured them through large insurance companies, paying the premiums with investors’ capital. If a borrower defaulted, the bank was covered. It didn't have a strong incentive to pick the most creditworthy borrowers, but it did have an incentive to lend at volume, since the bank earned additional fees with every loan.

The first real portent of trouble came from a distant quarter in 1925, as the fizzy Florida real estate market, fueled by New York mortgage bond funds, began to burst. In the wake of the Great Miami Hurricane of 1926, acres of sun-splashed housing developments sank back into the swamps, taking the interest payments on many bonds with them. Mortgage bankers around the country wrung their hands but consoled themselves that the system itself was sound. Those who grumbled, such as the economist C. Reinhold Noyes, who warned in The Yale Review against “financing prosperity on tomorrow’s income” and preached the inevitability of another turn in the business cycle, were ignored. Noyes predicted that “the motor industry” would “be the storm center of the next period of depression,” and would “be entirely to blame” for infusing installment credit so thoroughly into the economy. This depression, which he correctly predicted in 1927 to be “two or three years” away, would be “automatic and inevitable,” as it would be the result of “retribution for economic sin.”

In 1929, Noyes’s much more famous colleague, Yale professor Irving Fisher, pronounced that stocks, in this new economy, would never fall again. Three days later, on October 24, 1929, the world watched slack jawed as the stock market began to crash.

After the crash, which saw the stock market drop by nearly 40 percent, the public’s faith in the fundamental stability of American finance disappeared. Abruptly, investors withdrew $195 million from American banks—the first decline in deposits in 20 years. Banks that offered mortgage bonds collapsed at twice the rate of those that did not. Skittish investors stopped sinking money into mortgages. As a result, banks began demanding that homeowners facing balloon payments pay off their loans. Few borrowers had that much cash, and a wave of foreclosures hit the real estate market, scaring off more investors. A full-scale rout was under way.

By 1933, Americans were losing a thousand homes a day to foreclosures. The housing industry was effectively dead. The next year, the number of new homes built was exceeded by the number that burned down. One-third of the families on the dole found their way there due to the loss of a construction job.

When he took office in 1933, President Franklin D. Roosevelt assured Americans that while the economic crisis was unprecedented, it was within the government’s ability to remedy. It wasn’t a “plague of locusts” sent by an angry God that was to blame, but rather the “stubbornness” and “incompetence” of the “rulers of the exchange of mankind’s goods.” Restoring the mortgage markets was crucial to national recovery, and that meant that the financial instruments that had gone so badly awry—balloon mortgages and participation certificates—would have to be replaced.

Launched in 1933, the Home Owners Loan Corporation (HOLC) stopped the free fall in house prices by swapping government bonds for past due mortgages held by lenders, averting massive numbers of foreclosures and steadying the nation’s housing markets. (Like several other New Deal reforms, the agency had its origins in President Herbert Hoover’s 1931 White House Conference on Home Building and Home Ownership.) But the real financial innovations were the creation of the Federal Housing Administration (FHA) in 1934 and the Federal National Mortgage Association (Fannie Mae) in 1938.

As is the case today, private capital during the Depression was piling up in the coffers of bankers who were too afraid to lend it. The most imaginative part of the FHA plan was that it used this capital for public purposes. If they met certain requirements, lenders could chip in to an insurance pool, organized but not paid for by the federal government; if a mortgage loan went into default, the lender would be reimbursed from the pool. Strict eligibility criteria for the borrowers and houses limited moral hazard—the possibility that lenders backed by insurance would lend indiscriminately.

Even corporate CEOs were appalled to see some of America's great manufacturing firms gradually transformed into financial companies.

The FHA also made it possible to offer Americans much longer mortgages of 20 and (later) 30 years, which reduced the size of monthly payments and allowed borrowers to pay off both interest and principal. That step made home loans more affordable and eliminated the need for constant refinancing that had made balloon mortgages so dangerous.

Fannie Mae’s job was to fund these new mortgages. Whereas in the 1920s banks had to seek out investors to buy their participation certificates, under the new system they could simply sell mortgages they made to Fannie Mae, which would then resell them to insurance companies and other large institutional investors. The impact was huge. No longer were mortgage lenders limited by the amount of money they could raise locally. Now, thanks to Fannie Mae, bankers everywhere in America had ready access to the capital of Wall Street and other financial centers. By the end of the 1930s, at virtually no cost to taxpayers, the government had stabilized America’s housing markets.

The new mortgage system inaugurated a long period of stability. The suburbs, where the American dream would flourish, were built on its loans. But the new system had another effect: It further legitimated borrowing of all kinds. Indeed, the suburban housing supported by the FHA all but required that Americans acquire that other great generator of debt: the automobile. New Deal–era plans for urban housing that would have produced a landscape ripe for mass transit were scrapped. The FHA planners preferred colonials and lawns, and their regulations determining what would be eligible for cheap financing reflected their ideals.

Living in mortgaged homes, driving in financed cars, postwar Americans relaxed at new shopping centers. They borrowed more but also earned more, which meant that while the habit of borrowing grew, debt as a share of income remained relatively stable. Consumer credit kept factories humming, and those well-paid industrial jobs kept the debt burden contained. Banks and finance companies rather than capital markets funded the borrowing, which kept a leash on the credit available. The lender always had skin in the game.

The origins of the shift from a relatively egalitarian manufacturing economy to an unequal financial economy can be seen in the midst of this prosperity. During the 1960s, however, retailers confronted a dilemma. To keep growing, they needed to supply their customers with more credit, but if they did that, most of their capital would be tied up in consumer debt, unavailable for other needs. Into this gap stepped bank-funded credit cards—the forerunners of today’s VISA and MasterCard. At the same time, large corporations such as General Electric began to take over and upgrade merchants’ credit operations.

Americans have pulled back from the worst excesses of the past decade, but prosperity will not return until wages start rising again.

All of these developments during America’s flush postwar years helped breed new financial attitudes. The fullest expression of the era’s optimism was the resurrection of 1920s-style mortgage finance, albeit in a new form. In 1970, Fannie Mae began bundling large numbers of mortgages into a kind of security that could be easily traded in markets around the world, and which had the implicit guarantee of the U.S. government. The mortgage-backed security was first proposed in the Fair Housing Act of 1968 as a mechanism to help low-

income families buy housing. After the riots of the 1960s, it was clear to many policymakers that America’s cities needed more investment. But insurance companies, which had been the workhorses of American mortgage finance, were losing ground to pension funds as the largest investors, and they had no interest in buying individual mortgages. They would, however, buy bonds. Since FHA lending had buoyed the fortunes of the middle class in the postwar era, surely enabling more borrowing to help less affluent people couldn’t be a bad idea, policymakers reasoned.

The timing was unfortunate. Slowly, inexorably, the world that supported Americans’ postwar assumptions began falling apart in the 1970s as the international economic order shifted from American-dominated recovery back to a more normal state of global competition. The economic dislocations of the 1970s—inflation and deindustrialization—stemmed fundamentally from this return to normalcy. The stable growth of the postwar period that had rewarded budgeting and borrowing disappeared. With surging inflation and stagnating pay, real wages began to fall. In part to close the gap in household budgets, a greater proportion of married women than ever before entered the work force. But consumers also began to rely more on borrowing to make ends meet. The careful balance between rising debt and rising income was coming undone.

Now that the genie of securitization was out of the bottle again, that shift spelled extraordinary trouble. By the 1980s, car loans, credit cards, and even student loans could all be financed through the sale of bonds in the capital markets. Policymakers had hoped that the mortgage-backed security would be an easy fix for inequality, spreading the postwar prosperity to everyone. But what they had spawned was a value-neutral financial instrument that would enable investment in any kind of consumer debt. As profits in other parts of the economy receded, the profits of this kind of lending exploded. And as consumer debt began to crowd out business debt, less money was available to invest in productive businesses and create the kinds of good jobs that had made America’s postwar formula work.

When Jack Welch took the helm at General Electric in 1981, largely on the strength of his success in managing the company’s consumer finance division, his vision was clear, he would later write: “Finance is not an institution—it has to be . . . the driving force behind making General Electric ‘the most competitive enterprise on earth.’ ” Some older divisions, such as the lighting operations, would be continued, but the profits would be reinvested in financial products. Other GE businesses that were experiencing declining profitability, such as the one that made toasters and clocks, would be sold.

* * *

Louis Hyman teaches history at the Industrial and Labor Relations School at Cornell University. This essay is adapted from his new book, Borrow: The American Way of Debt. Copyright 2012 by Louis Hyman. Published by arrangement with Vintage Books, an imprint of the Knopf Doubleday Publishing Group, a division of Random House, Inc. Image courtesy of Flickr/Alan Light